Props for the “Reg A” Reality: A lesson in digital asset securities offerings

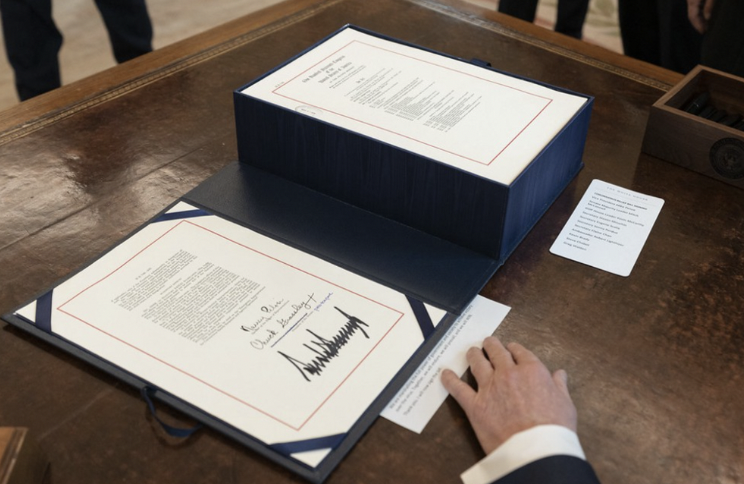

It pains me to say it, but Open Props’ recent announcement of the coming termination of its ongoing Regulation A (“Reg A”) digital asset securities (Props) offering and the cessation of support for its Props Loyalty Program leads me to one stark conclusion.

#2 Did You Know: Eligible Securities

Regulation A (“Reg A”)[1] is a great way for smaller companies to raise funds through the sale of securities — up to $50 million a year — including companies wishing to issue securities tokens. It offers a number of benefits to such companies, including the ability to (1) sell unrestricted (i.e., freely transferable) securities (2) on a continuous basis over time (3) to a variety of investors, regardless of their income or wealth (4) without having to register the securities at a state-by-state level.

COVID-19: Legal Considerations for Startups and Fintech Companies

The current global pandemic raises a number of potential legal issues for businesses of all sizes. We list below the most relevant concerns we expect to see for startups and financial technology companies, to help isolate issues during the crisis so companies can resolve them one by one. We also outline special concerns for companies facing consumers and those offering regulated financial services in New York State.

Hindsight from 2020: Notable Regulatory Events for Blockchain in 2019

Ketsal’s team of lawyers put our heads together in early January to reflect on the prior year and what it means for the one to come. Regulators really did step it up this year. There’s a lot to digest.

The Reg A Gambit

The term “decentralization” can mean many things to many people. For securities lawyers, the subsets of architectural decentralization and political decentralization (distinguished in this article) carry the most weight. Essentially, is the network built so that no small group of nodes can shut it down? Is it built so that no small group of individuals has control over key governance decisions?

“I want New York to win” — Assemblyman Clyde Vanel

On May 14, 2019, we had the honor to host New York State Assemblyman Clyde Vanel and State Senator James Sanders Jr. during Blockchain Week in New York City.

![How We [sic] Failed and Could Do Better](https://images.squarespace-cdn.com/content/v1/62bdea2faf413c5a8cc725c7/1680818609643-6G93VCS4MIMJIHS4HP0M/Screen+Shot+2023-04-06+at+6.03.25+PM.png)

How We [sic] Failed and Could Do Better

Securities law practitioners learn early that there is a distinction between a “security” and a “transaction in a security.” In fact, the first substantive thing the Securities Act of 1933 does is define the term “security” before going on to describe how it regulates the offer and sale of (i.e., transactions in) securities.

Howey, Staking as a Service, and Technological Nuance

Innovations in blockchain often act as a building block for new businesses. Consider the original innovation, Bitcoin’s proof-of-work consensus mechanism: a new business model sprang up to take advantage of the opportunity to pool processing power to generate revenue in the form of bitcoin rewards.