SEC Division of Corporation Finance: Actions in a Potential Government Shutdown

Like many federal agencies, the U.S. Securities and Exchange Commission (SEC) is facing an imminent potential lapse in appropriations at midnight tonight (September 30, 2023). In advance of a potential government shutdown, SEC staff in the Division of Corporation Finance (CorpFin) published a summary of the anticipated impact on its operations, along with updated registrant guidance for those that have or expect to have filings or open matters before the staff.[1] As described, CorpFin expects any government shutdown to result in “extremely limited” activities by its staff. This could have a material affect on some companies, as the last government shutdown in December 2018 lasted 34 days.

If a shutdown commences, CorpFin staff will not be available to review filings, issue comments or take registration statements effective or qualify Regulation A offering statements. Additionally, absent extraordinary circumstances, CorpFin will not consider requests for exemptive relief.

Some of the highlights from the guidance are summarized here:

EDGAR. The EDGAR filing system will remain open and accept filings, including transaction-related proxy and registration statements, and filing-related correspondence. EDGAR codes and fee-related questions may continue to be processed by a limited number of technical staff. All required filings must continue to be made, including periodic and current reports required by the Securities Exchange Act.

CorpFin Staff responses. CorpFin legal and accounting staff will not provide interpretative advice, issue no-action letters, review filings (including Regulation A offering statements), or process requests for accelerating the effectiveness of registration statements or qualification of Regulation A offering statements.

WKSIs and non-WKSIs with effective shelf registration statements. Given automatic effectiveness of Forms S-3/F-3, well-known seasoned issuers (WKSIs) will be able to continue to access the public markets. Non-WKSIs with eligible shelf registration statements similarly can access the public markets through shelf takedowns and prospectus supplements.

Delaying Legends (Registration Statements). CorpFin’s guidance addresses a process available to a limited subset of new registration statements that may become effective under statute (without SEC action) through the removal of the “delaying amendment” by amending the registration statement to exclude the delaying language required by Securities Act Rule 473. In such cases, the registration statement will become automatically effective 20 days thereafter. Similarly, new registration statements may omit the delaying amendment and become effective 20 days after the initial filing.

Registrants should be extremely careful if they are considering this option, as there are a number of traps that may be triggered and implications that could arise with the filing when the government shutdown ends and CorpFin staff commences again with normal operations.

Post-effective amendments. Companies that need to update the information in a prospectus for an effective registration statement by filing a post-effective amendment or in an offering circular for a qualified offering statement by filing a post-qualification amendment pursuant to Regulation A will be unable to continue with their offering until the shutdown ends and the staff declares the amendment effective or, in the case of Regulation A, qualifies the amendment.

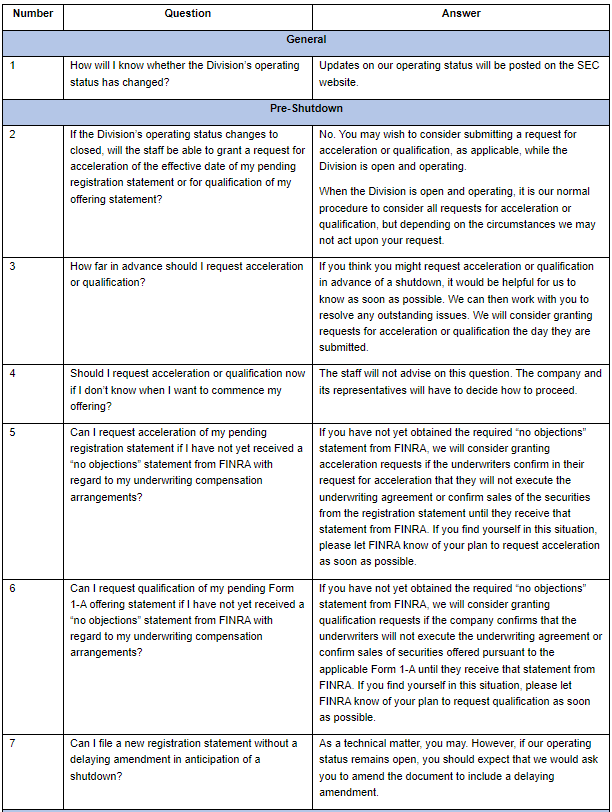

CorpFin has provided the following guidance to address questions that Companies may have.

[1] SEC, Division of Corporation Finance Actions In Advance of a Potential Government Shutdown (September 27, 2023), available at: https://www.sec.gov/corpfin/announcement/announcement-cf-pre-shutdown-communication-092723. See also Announcement Regarding Pending Registration Statements and Offering Statements (September 29, 2023), available at: https://www.sec.gov/corpfin/announcement/announcement-cf-pending-registration-statements-and-dffering-statements-092923.