Howey, Staking as a Service, and Technological Nuance

Josh Garcia (Principal and Co-Founder of Ketsal Consulting, LLC and Blakemore, Fallon, Garcia, Rosini & Russo, PLLC)

Innovations in blockchain often act as a building block for new businesses. Consider the original innovation, Bitcoin’s proof-of-work consensus mechanism: a new business model sprang up to take advantage of the opportunity to pool processing power to generate revenue in the form of bitcoin rewards. One person contributed X% of processing power to a mining pool and received X% of proceeds. Consider altcoins: they motivated early crypto-enthusiasts to launch the first crypto-to-crypto trading sites, generating revenue from transaction fees.

Today, core technology has allowed retail clients to put their money to work. Take proof-of-stake, crypto-based lending pools, delegated proof of stake, and accessible financial products built on-chain: like prior innovations, each creates new business opportunities. And, like prior innovations, each will run up against old questions of law.

Blockchain-Based Businesses

Consider two services that may take custody of funds from retail clients and return revenues based on the managerial efforts of the service provider. For instance, pooled lending services may pool digital assets from retail clients, sell loans from that pool, and distribute performance-based revenue pro rata (“Pooled Lending”). Staking-as-a-service (“StaaS”) providers may pool digital assets from clients and distribute revenue as a result generated from their managerial efforts. If some of this language sounds familiar, it’s because it has been repeated ad nauseum by regulators, advisors, and lawyers counseling on the elements of the Howey test.

As a quick reminder, the Howey test is the Supreme Court’s view on how to determine if a given transaction constitutes an investment contract, a type of security. The test requires looking at whether money was invested in a common enterprise and whether the people investing that money expected returns from the managerial efforts of a third party.

Pooled Lending and StaaS, or what we refer to generally as client-funded revenue-generation (“CFRG”) services, contain the exciting potential to drive adoption of digital assets. In particular, they allow Joe Crypto to put otherwise-idle digital assets to work. An unsophisticated HODLer — or one with other things keeping him busy — can now place funds with a company and rely on that company to use them to produce returns on the HODLer’s behalf, banks be damned.

New Revenue Streams, Old Law

Novel business models, however, must contend with established laws. Mining pools have generally not run afoul of the securities laws likely because users mainly rely on their processing power contributions to obtain revenue, not on the managerial efforts of others. Mere trading on crypto-to-crypto exchanges, absent the involvement of a digital security, does not implicate Howey because traders trading on their own behalf expect to generate revenue primarily from their own trading prowess and philosophies, not (let’s say it again) the managerial efforts of others.

The main potential hurdle for CFRG services becomes apparent when one compares the economic realities of their services to the plain text of Howey. Some CFRG service providers explicitly offer their managerial efforts to retail consumers, who can then deposit funds, sit back, and passively wait for a return on investment.

This rapid analysis comes at a price. It leaves tremendous room for overzealous application. Any regulator considering a blanket rule for CFRG service providers may be surprised to learn the technology underpinning such services varies widely. It is unlikely every Pooled Lending or StaaS provider, for instance, will implicate securities laws. Thankfully, the Howey test requires regulators to look at each case individually, to review closely the facts, circumstances and economic realities of each arrangement. And the EtherDelta/Coburn Order stands out as a shining example of the SEC’s ability to tackle technological nuance involving blockchain technology.

Identifying Technological Nuance

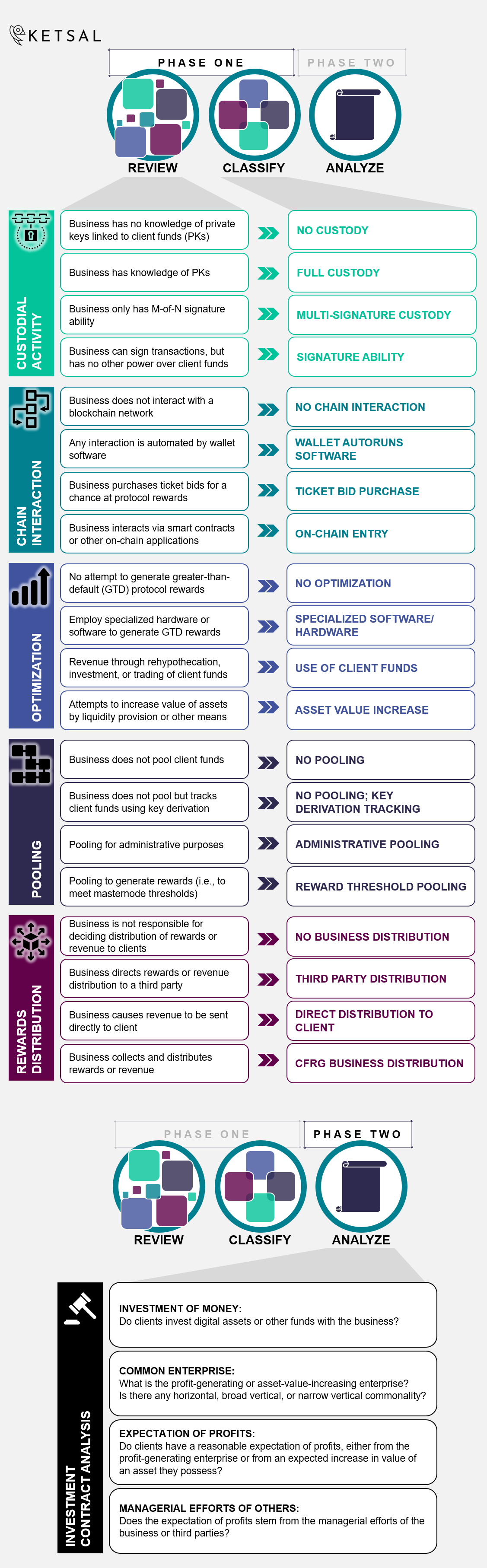

With those general caveats, we offer the following infographic as a guide for anyone — regulator, company, fellow lawyer — in search of a formulaic approach to the difficult task of labeling the various activity bound up in CFRG services.

The image below should provide a roadmap for anyone preparing to engage in a nuanced analysis of CFRG services. Phase One involves reviewing the type of activity the CFRG service provider engages in (e.g., Custodial Activity) and then classifying that activity into a discrete subset (e.g., No Custody versus Full Custody). Phase two involves the application of a legal standard; by way of example we chose the Howey test, but the legal standard could just as easily have been money transmitter law or regulation.

With respect to Howey, we note that in some cases a business may do very little on behalf of others, while in others a business may exert great effort or engage in highly specialized activity to generate revenue for their clients. A business’s level of activity and its marketing of that activity will certainly inform the “managerial efforts of others” or other fact-sensitive prongs of the Howey test. The labels (especially, for instance, “No Pooling” or “No Optimization”) can provide helpful heuristics for anyone pitting the complex facts of a CFRG service provider against a longstanding legal standard.

This graphic represents a suggestion as to process. It does not purport to be a substitute for a comprehensive technological review performed by a competent securities lawyer. Note that any service involving client-funded methods to generate revenue, such as the work performed by delegates in a delegated proof-of-stake network, may be analyzed using this suggested process.

Conclusion

No matter how innovative the revenue-generation technique or how novel the blockchain-based financial product, regulators have discretion to apply existing legal frameworks to entire swaths of innovation, even where the fit is less than perfect.

Clearly, not every CFRG service should, as a matter of policy, be considered an investment contract. Businesses can help prevent overbroad application by broadcasting, in the first instance, that technological nuance and precision can and should make a world of difference under the securities laws.